Transformation and Impact Will Vary By Industry and Geography

Authors: Victor Calanog PhD , and Vivek Thadani from Moody’s Analytics REIS.

On Thursday, April 16, Morgan Stanley CEO James Gorman told Bloomberg News that the firm “could operate with much less real estate.” The firm had plans for its workforce to move back to their offices, pending place-specific policies for reopening. However, given that the investment bank has now had experience moving the majority of its 80,000 employees to a remote work model, it is preparing for a future in which its commercial leasing commitments (and associated expenses) are significantly reduced.1

“We’ve proven we can operate with no footprint,” Gorman said.

“Can I see a future where part of every week, certainly part of every month,

a lot of our employees will be at home? Absolutely.”

On the same day, Andrew Cuomo echoed Gorman’s sentiments by encouraging businesses to “reimagine their workplace” in an official statement. “How many people can continue to work from home and the business still works?”2

How will COVID-19 reshape the dynamics of office space as an income-generating asset class? In fact, the office sector has changed significantly over the last four decades. In this paper we will discuss why the COVID-19 crisis is likely to accelerate this evolutionary process. Where are the transformational effects likely to be felt with greater impact, and why?

The Immediate Impact of COVID-19

With all of these instructive historical lessons in mind, we must recognize that the impact of COVID-19 on the US economy is unprecedented. Moody’s Analytics expects US GDP to decline by 30% on an annualized basis in the second quarter of 2020—triple the severity of the previous record decline of 10% in the first quarter of 1958. Over the course of all of 2020, US GDP is expected to fall by 6.6%, a larger magnitude than the decline in economic activity in 2008-2009, concentrated mostly in the second quarter, prior to reopening the economy.

The near-term impact and the policy response. With businesses forced to close shop in mid-March (and many still closed as of this writing), economic distress came swiftly. According to a survey by NAREIM, more than half of office tenants had asked for some form of rent relief by the end of March.10 The policy response has been relatively swift, with the CARES Act approved on March 26 earmarking $350 billion of support for small businesses (funds that could be used to pay rent). Another $480 billion of support for small businesses was approved by the Senate on April 21, driven by the need to replenish the first tranche of relief to small businesses from the CARES act.

On April 9, the Federal Reserve included support for legacy commercial mortgage-backed securities in an amended Term Asset-Backed Loan Security Facility (TALF), providing an additional backstop propping up liquidity and credit for commercial real estate loans. The initial TALF program covers up to $100 billion in loans to support credit markets. For Commercial Mortgage Backed Securities (CMBS),11 the funds are geared towards providing relief by accepting legacy and conduit eligible securities as loan collateral.

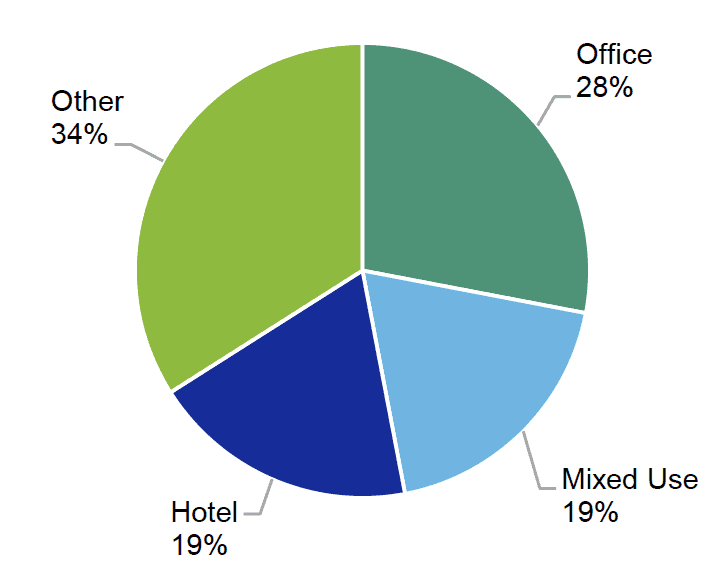

Support across property types, however, has been uneven. For example, Single Asset-Single Borrower (SASB) deals are excluded from the TALF program. SASB outstanding balances sum up to approximately $156.3 billion12 and the largest proportion of properties underlying SASB securities (28%) are in the office sector, as per Moody’s Analytics data.13

Figure 4: Outstanding Balance by Property Type, CMBS SASB Deals

Source: Moody’s Analytics Structured Finance Portal

Because current policy efforts at supporting businesses have excluded large SASB loans, office property owners and operators are not provided with aid that would have helped them extend credit during these challenging times.

Furthermore, SASB securities tend to be owned by larger institutional investors such as pension funds and insurance companies. Subjecting relatively larger institutions to greater stresses may expose the financial system to bigger systemic risks, which could create unintended second order effects in the credit markets. Policymakers are caught in classic considerations of systemic risk: despite the large amount of funds pledged for support across various sectors of the economy, prioritization is still required. Should support be directed towards small businesses and the housing sector (as they currently are) or should more funds be allocated to larger institutions that may pose bigger systemic risks to the financial system?

Despite the vast amount of support from fiscal and monetary policy, if the severity of this economic downturn exceeds that of 2008-2009, then expect the office sector to suffer significantly. REIS’s baseline forecasts have national vacancies spiking by 260 basis points to 19.4% by the end of 2020. That is an historic high: the previous record high at the national level was 19.3% in 1991 during the savings and loan crisis. Even if economic recovery ensues by later this year, reopening efforts might not go as smoothly—and office vacancies are likely to keep rising through 2022, topping out at 20.2%.

Find Office Vacancy Rates by City

Find Office Vacancy Rates by City using the Moody’s Analytics REIS Network, the leading sources of CRE data for office properties, covering every county in the US.